With so much going on in the world now, life insurance might not seem like a hot topic at the dinner table. However, because so much has happened in the past year, people are more likely to be discussing what they need to do to be prepared for emergencies. Because of Covid-19, mortality and financial wellness have been brought into sharp focus and more people are seeking life insurance coverage to protect their families. 31% of Americans say they are likely to buy life insurance compared to 11% in 2011. If the pandemic has prompted you to think about how life insurance could give your family more financial security, you might be wondering about the types of life insurance available. There are several options, but if you’re young and healthy, term life insurance can be a good place to start. Term insurance can be an attractive option to many due to its affordability. Term insurance can help families make sure they will be able to maintain their lifestyle and keep their dreams within reach even if a family wage earner dies.

With so much going on in the world now, life insurance might not seem like a hot topic at the dinner table. However, because so much has happened in the past year, people are more likely to be discussing what they need to do to be prepared for emergencies. Because of Covid-19, mortality and financial wellness have been brought into sharp focus and more people are seeking life insurance coverage to protect their families. 31% of Americans say they are likely to buy life insurance compared to 11% in 2011. If the pandemic has prompted you to think about how life insurance could give your family more financial security, you might be wondering about the types of life insurance available. There are several options, but if you’re young and healthy, term life insurance can be a good place to start. Term insurance can be an attractive option to many due to its affordability. Term insurance can help families make sure they will be able to maintain their lifestyle and keep their dreams within reach even if a family wage earner dies.

What Does a Term Insurance Policy Do?

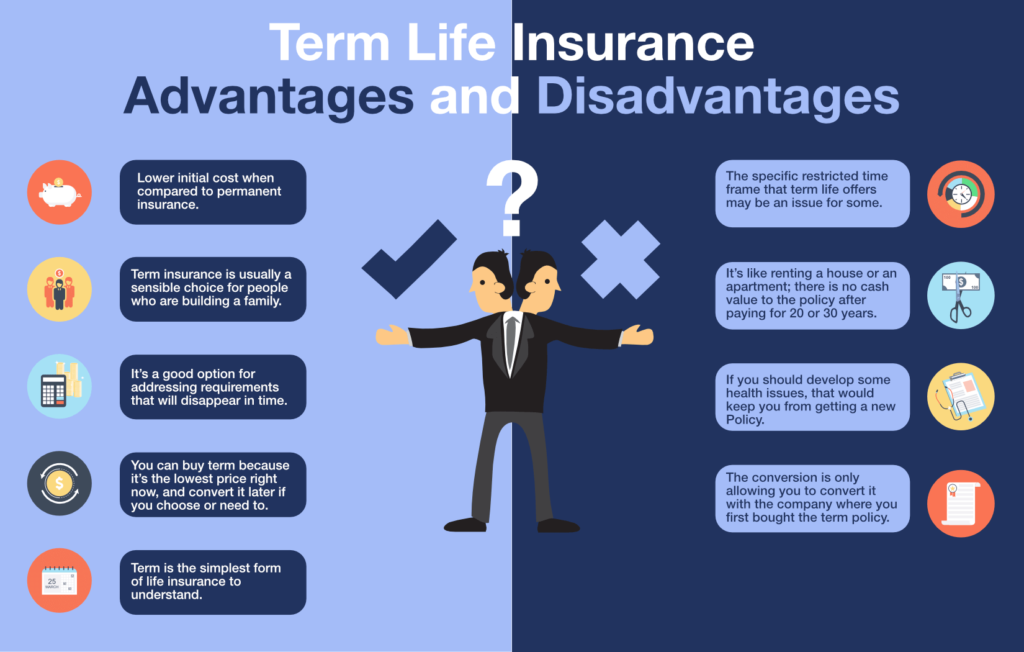

A term life insurance policy provides coverage for a predetermined number of years. This type of life insurance only pays a death benefit if the policyholder dies before the term is up. It doesn’t accumulate a cash value that can be used for loans and other purposes like permanent life insurance can do. A term life insurance policy is the simplest, purest form of life insurance: You pay a premium for a period of time – typically between 10 and 30 years – and if you die during that time, a cash benefit is paid to your family (or anyone else you name as your beneficiary.) Term insurance will offer future insurability. The following are significant benefits of buying term insurance for your long-term financial plan.

Term Life Policies Can Have a Conversion Feature

Protection through health changes. If you develop health problems that make life insurance more expensive or disqualifies you, your term policy will allow you to convert your term policy to a permanent policy before it expires without going through a medical exam. Just make sure your term life insurance policy has a conversion plan. We never know what life can hand us in regards to our health condition.

Employer-provided Coverage Is Typically Not Nearly Enough To Protect Most Households

In most instances, workers merely accept the free life insurance benefit without thinking it through. Nothing wrong with free, but free isn’t necessarily enough. or you could lose the employer-provided group coverage. 10% of workers lost their protection during the pandemic. An optional term life plan makes it ideal to have a combination of coverage individually. The term insurance offers higher levels of coverage and more stability during employment disruptions. Chances are you need to venture into the individual market and buy a term life insurance policy. If you’re in good health and on the younger end of the age curve, the individual market will likely be less expensive than the premium for buying more coverage through the group plan at work.

What Happens If You Live Longer Than Your Term Life Insurance?

If you outlive your term policy, your policy will end, and you will no longer have coverage. If you still want life insurance after your term policy ends, you may have the option to buy a new life insurance policy or consider a term conversion policy.

Final Expenses and Debt

Technically, personal debts aren’t forgiven at death. Instead, they pass to the estate of the deceased person. Losing a loved one is hard on so many levels. Funeral arrangements and estate matters have to be dealt with in the midst of grief—and questions abound. Term life insurance will be a godsend during that trying time for your family. Most Americans have debt; so, life insurance can help pay off debts while maintaining and forging ahead in pursuit of your loved one’s lifestyle.

Contact us (859-781-7283) for more information or get a free quote!

—

About Rollins Insurance

About Rollins Insurance

Rollins Insurance is an independent insurance agency providing our clients the best prices with the most coverage possible since 2008. We represent multiple A-rated insurance companies to make sure we deliver the most competitive rate packages to our clients in Kentucky and Ohio. We find that most people are under-insured and over-paying when we meet them. We love what we do and our primary business is Personal Auto, Homeowners, and Life and Health insurance. We are a family-owned and managed business that specializes in providing needs-based insurance services.

>> Learn More About Us and Our Staff