by Rollins Insurance | May 1, 2024 | Auto Insurance

When you apply for auto insurance your insurer will use your risk rate to determine your cost. Those with a bad driving record pose a higher risk to insurers. So they will have to pay more for their coverage. If you worry about how much a bad record will cost, you are...

by Rollins Insurance | Mar 22, 2024 | Auto Insurance

Finding the best auto insurance rates is a crucial step in protecting your finances and ensuring peace of mind while driving. With so many insurance companies and policies available, it can be overwhelming to navigate through the options and determine which one offers...

by Rollins Insurance | Jan 15, 2024 | Auto Insurance

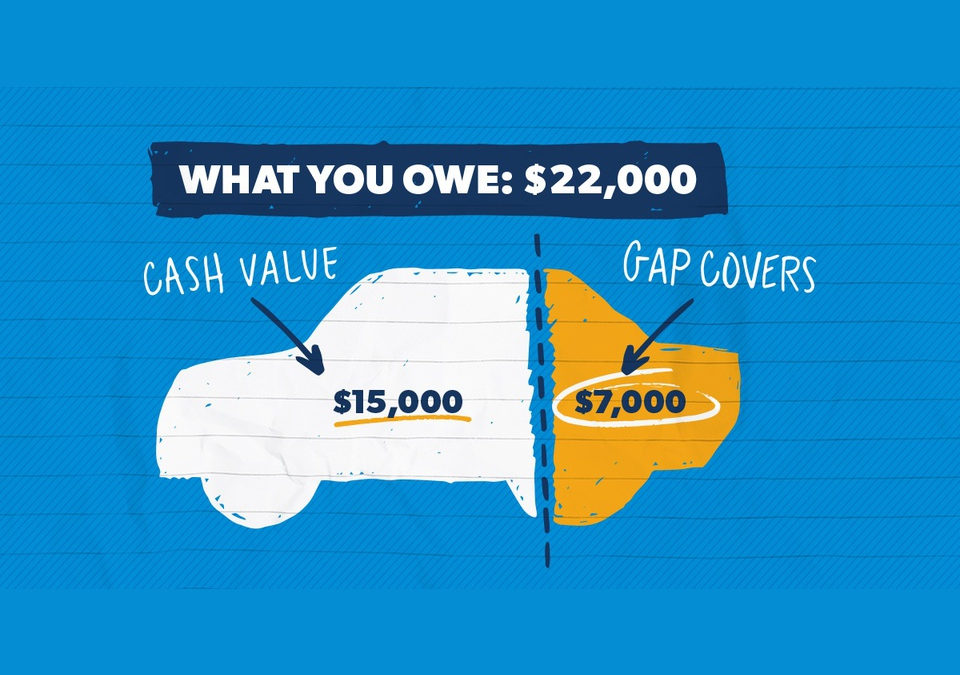

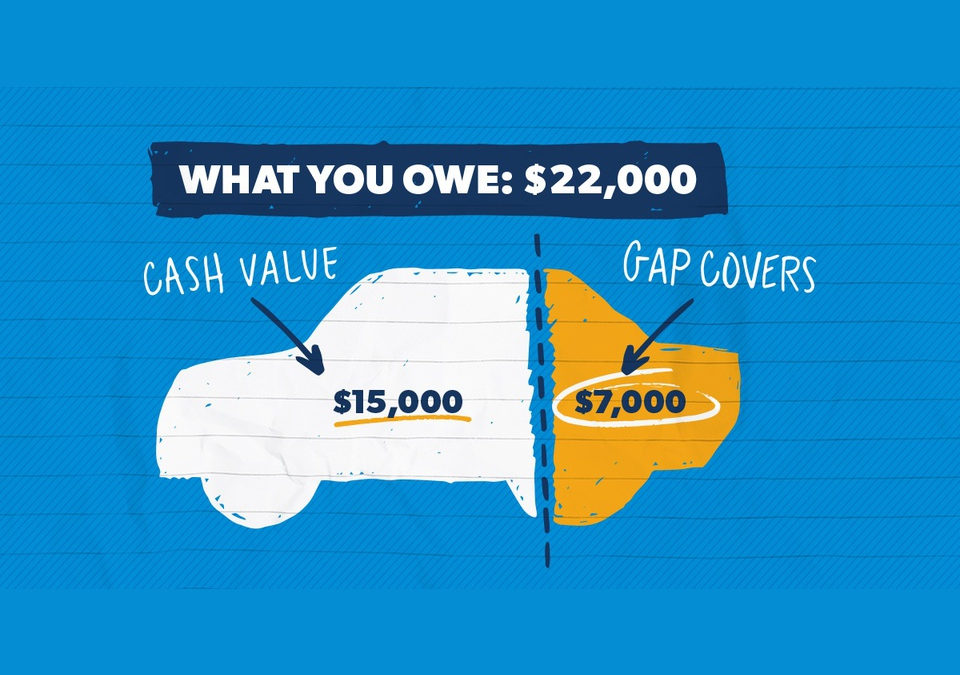

Let’s first define GAP insurance. Gap insurance is an optional car insurance coverage that helps pay off your auto loan if your car is totaled or stolen and you owe more than the car’s depreciated value. GAP is an acronym for Guaranteed Auto Protection....

by Rollins Insurance | Jan 1, 2024 | Auto Insurance, Health Insurance, Homeowners Insurance, Life Insurance

The legal act of getting married, as opposed to just living together, can have some immediate impacts on your financial situation. Sitting down to do monthly budgets together and opening joint checking and savings accounts are all part of merging your lives. Just...

by Rollins Insurance | Dec 15, 2023 | Auto Insurance, Homeowners Insurance

In today’s world, where cutting costs is a top priority for many, finding ways to save money on essential expenses like home and auto insurance is a smart move. One option that can help you achieve this is bundling your home and auto insurance policies together....

by Rollins Insurance | Aug 22, 2023 | Auto Insurance

If you’re like many Americans, you might often wonder if you’re paying too much for your auto insurance premiums. You’ve likely searched the internet for ways to cut costs. There are several things to assess when looking at your premium rates and how to reduce them....